Online cfd trading

You won’t be able to place a trade unless there are sufficient funds in your account to open a position. If you prefer to test strategies in a risk-free environment, our free demo account will allow you to practise trading with virtual funds Versus Trade.

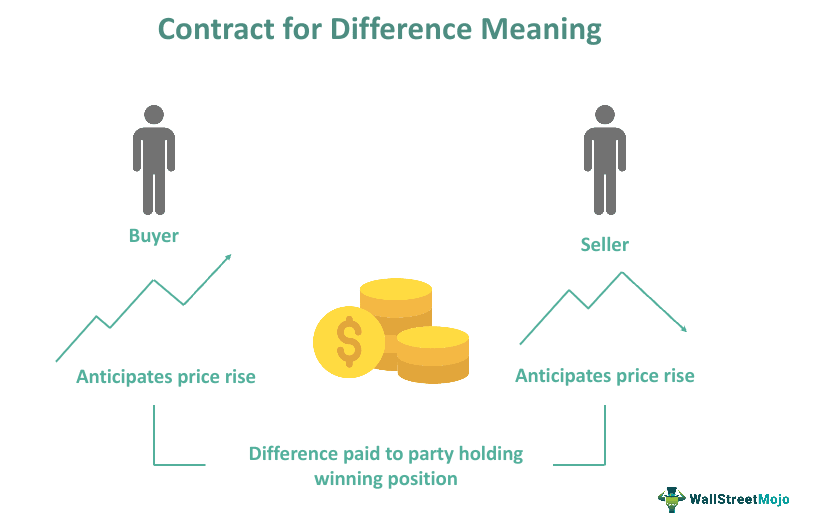

Contract for Difference (CFD) trading is a financial derivative that allows traders to speculate on the price movements of various financial instruments without actually owning the underlying assets. CFDs are popular in financial markets, including stocks, indices, commodities, currencies, and cryptocurrencies. This article will help you understand CFD trading better.

Risk Management: Implement effective risk management practices, including setting stop-loss orders to limit potential losses. Determine the size of each trade based on a small percentage of your total trading capital. Never risk more than you can afford to lose on a single trade.

CFD trading, or Contract for Difference trading, is a financial arrangement where you don’t actually buy or sell the underlying asset (like stocks, commodities, or currencies), but instead, you enter into a contract with a broker to speculate on its price movements. The name “Contract for Difference” comes from the agreement to exchange the difference in the asset’s value between the opening and closing of the contract.

You profit from CFD trading by accurately predicting price movements, going long in rising markets, and going short in falling markets, leveraging both market directions for potential gains while employing effective risk management strategies.

Online cfd trading

“Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support.”

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Quality research, and integrated trading signals: One of the main reasons Saxo is among my top choices for CFD trading has to do with the quality of its research across such a wide range of tradable CFDs, and integrated trading signals within its platform suite. Saxo’s high quality research and integrated trading signals can make it more efficient to find and act on trading opportunities and to analyze news events in relation to market price movements.

“Pepperstone stands out as a top choice for day trading, offering razor-sharp spreads, ultra-fast execution, and advanced charting platforms for experienced traders. New traders are also welcomed with no minimum deposit, extensive educational resources, and exceptional 24/7 support.”

“With a low $5 minimum deposit, advanced charting platforms in MT4 and MT5, expanding range of markets, and a Zero account offering spreads from 0.0, XM provides all the essentials for active traders, even earning our ‘Best MT4/MT5 Broker’ award in recent years.”

Cfd trading meaning

Few or no fees are charged for trading a CFD. Brokers make money from the trader paying the spread. The trader pays the ask price when buying and takes the bid price when selling or shorting. The brokers take a piece or spread on each bid and ask price that they quote.

CFDs offer sophisticated traders a capital-efficient way to speculate on price shifts across global markets without owning underlying assets. While the leverage, market accessibility, and trading flexibility make CFDs attractive to experienced investors seeking diversified exposure, these advantages come with significant risks.

CFDs allow investors to trade the price movements of futures but they’re not futures contracts by themselves. CFDs don’t have expiration dates containing preset prices. They trade like other securities with buy-and-sell prices.

Few or no fees are charged for trading a CFD. Brokers make money from the trader paying the spread. The trader pays the ask price when buying and takes the bid price when selling or shorting. The brokers take a piece or spread on each bid and ask price that they quote.

CFDs offer sophisticated traders a capital-efficient way to speculate on price shifts across global markets without owning underlying assets. While the leverage, market accessibility, and trading flexibility make CFDs attractive to experienced investors seeking diversified exposure, these advantages come with significant risks.

CFDs allow investors to trade the price movements of futures but they’re not futures contracts by themselves. CFDs don’t have expiration dates containing preset prices. They trade like other securities with buy-and-sell prices.